Visa: Stop Swiping For Now

Summary

Visa's global presence and internal growth seem to be fueling over-excitement.

Despite its amazing brand recognition and proven, strong management, regulatory, and market risks don't match the overly positive sentiment regarding the company.

Opportunities and challenges are mixed, but Visa's long-term vision puts the company in a better position in the future than it seems to be now.

While my DCF shows Visa is 44% overpricing, it doesn't show the full picture.

I recommend holding for now until the market proves more stability and Visa shows sustained growth.

Richard Drury

Thesis

Despite Visa's strong internal growth and global presence, the current macroeconomic situation puts the company at risk. My article describes why I believe Visa's stock is a hold.

Intro

No need to explain why Visa seems to be one of the safest companies to invest in. Their global presence, integrated solutions, hard-to-substitute product, great revenue generation, amazing margins, stunning cash flow, and incomparable growth strategy, including investments and acquisitions, let alone their brand recognition, say it all.

Their 2024 10-K presented a net increase in revenue generation led by their consumer credit and debit growth, along with their marketable and non-marketable positive investments. However, what caught my attention was the increase in customer incentives and the presence of a significant amount of cash flow being restricted and earmarked for the U.S. litigation escrow account, customer collateral, and certain ongoing investments and owned assets.

While cash flow use is a matter of management choice — management that already proved its competence by continuously beating its estimates, including last quarter's revenue surprise — I needed to know why client incentives kept going up:

The first reason that came to my mind was the increase in users, leading to more incentive needs.

The second option was the necessity of increasing the incentives because of a lack of confidence, convenience, or desire to use Visa's network.

But before diving into it, I had to verify the intrinsic value of the company.

Why People Pay The Platinum Price for Visa

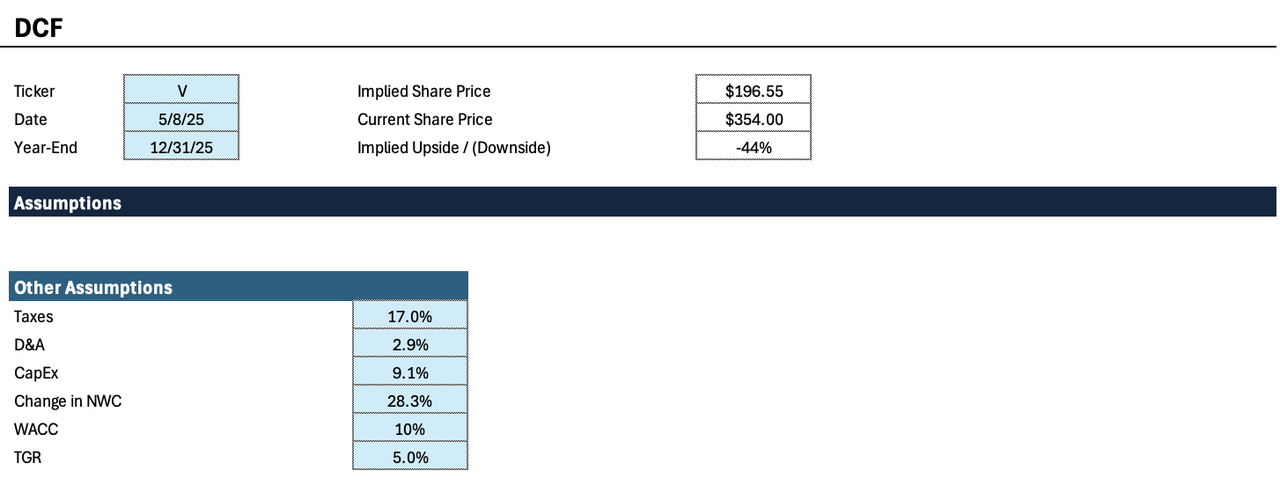

My DCF model made the case of a clear current overvaluation of 44%. However, it doesn't tell us the full story.

Visa's DCF (Personal Work)

To build it, I based my assumptions more on Visa's SEC filings (10-K and 10-Q) and on most analysts' coverage sentiment, rather than on my current analysis of the credit market sentiment and consumer spendings.

Therefore, I kept Visa on the same revenue growth of around 10% - 11%, breaking it into the following components:

Service revenue.

Data processing revenue.

International transaction revenue.

Other revenue.

Client incentives (being negative for the company).

Regardless of market and regulatory risks exposed in the 10-K filings, such as government incentives to use domestic solutions and new technologies on the horizon, such as the CBDC (Central Bank Digital Currencies), I placed my assumptions on the company's strong management and acquisitions strategy.

Management knows what it's doing when making strategic acquisitions. It expanded its reach recently with the acquisitions of Pismo in January of last year, a "cloud-native API platform" as a banking and card solution, as well as FeatureSpace, a transaction monitoring solution for fraud and financial crime prevention, last December. These are added to the investment recently in BVNK, a stablecoin infrastructure startup.

So, I kept the EBIT at around 67% margin, the CapEx steady based on historical average, and Net Working Capital (NWC) decreasing while expecting more efficiency from this big whale.

Finally, I chose to go with a 10% discount rate and a 5% terminal growth rate based on Visa's global presence advantage and aggressive acquisition strategy, a premium added to the 2.8% current GDP growth. Note that this GDP growth is a global average considering the potential success of Visa to grow in Asia, where the GDP growth ranges between 4% and 6%, contrasting with Europe and the U.S.'s numbers being below 3%.

I ended up with an intrinsic value, or implied shared price of $197, quite a bit lower than its current share price of $354. I deemed that too low to reflect the reality of Visa's value.

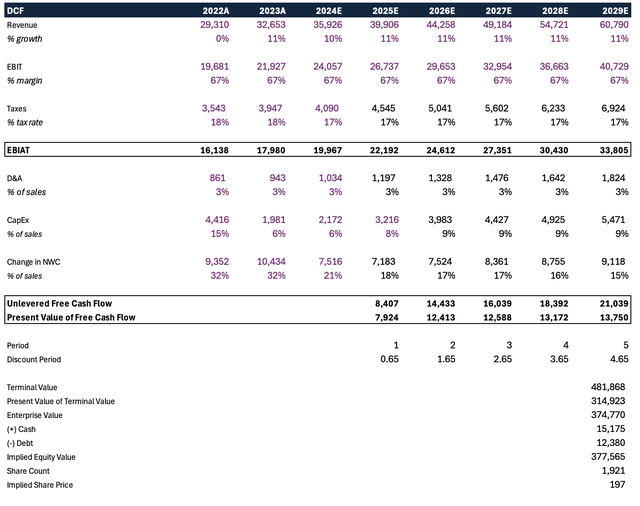

Visa's DCF results (Personal Work)

For more clarification, I arrived at this cash flow projection by only taking the FREE cash flow into consideration. This means that I deducted any restricted cash flow mentioned in the 10-K and 10-Q, including the U.S. and the VE territory covered litigation provision, or any investment currently held. I broke down the 3 statements and readjusted every line by eliminating any cash flow that cannot be used freely was instead restricted.

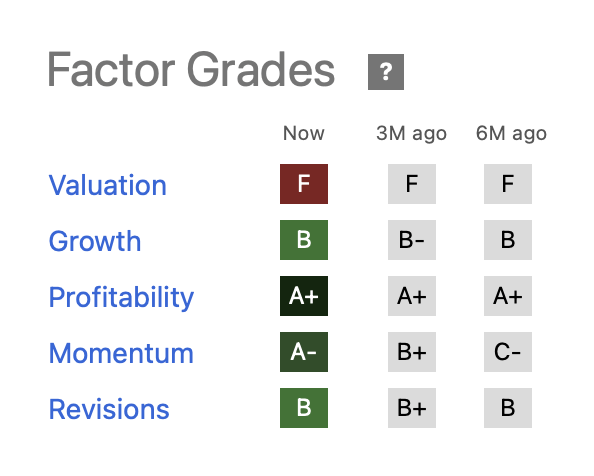

When diving into other types of valuation, I kept seeing confirmation that Visa is overpriced. The P/E ratio of 35x and the EV/EBITDA ratio of 25x confirmed the F factor grade on valuation.

Visa Factor Grade (Seeking Alpha)

From there, I dived back into my question: What is driving Visa's current incentives spending?

Visa Maxing Out On Upside Potential

This question led me to understand the overall situation of the company within the unstable 2025 market, and the unreasonable excitement about the company's stock.

The 10-K highlighted some regulatory risks along with government incentives imposing restrictions and obligations preventing international payment systems, like Visa, from competing against domestic providers, including significant markets like China and India.

On top of that, rules regarding data privacy and AI regulations might also reduce the company's capacity to freely process transaction data, directly impacting its revenue structure and potentially eroding its earnings.

Market sentiment, market momentum and the put/call options ratio suggested fear, contrasting stock price strength and breadth, indicating greed over fear. I consider momentum and put/call options as a better current reflection of reality than stock prices, as they translate a more forward-looking view of any analysis. The reason is simply that the current stock price is what investors have digested already. What we are analyzing with a forward-looking perspective would make it unreasonable to use stock price as an analytical component. In other words, the stock price cannot impact itself, unless it influences people's behavior, which I currently don't believe is the case.

On top of that, U.S. GDP fell by 0.3% in the first quarter, while the Fed is warning of stagflation risks and keeping interest rates at the same level.

But what seems to be some direct risks for Visa are the credit market and consumer spending. The tariffs set by the U.S. are expected to push total costs in the U.S. capital goods sector up by 8 to 10%, potentially slowing consumer spending. This is getting confirmed by spending intentions, reflecting what consumers are looking to spend on over the next four weeks. Spending dropped 9% and there was an increase of 1% in saving and investing. So, despite the recovery from 2022, the pace of growth seems to be losing momentum.

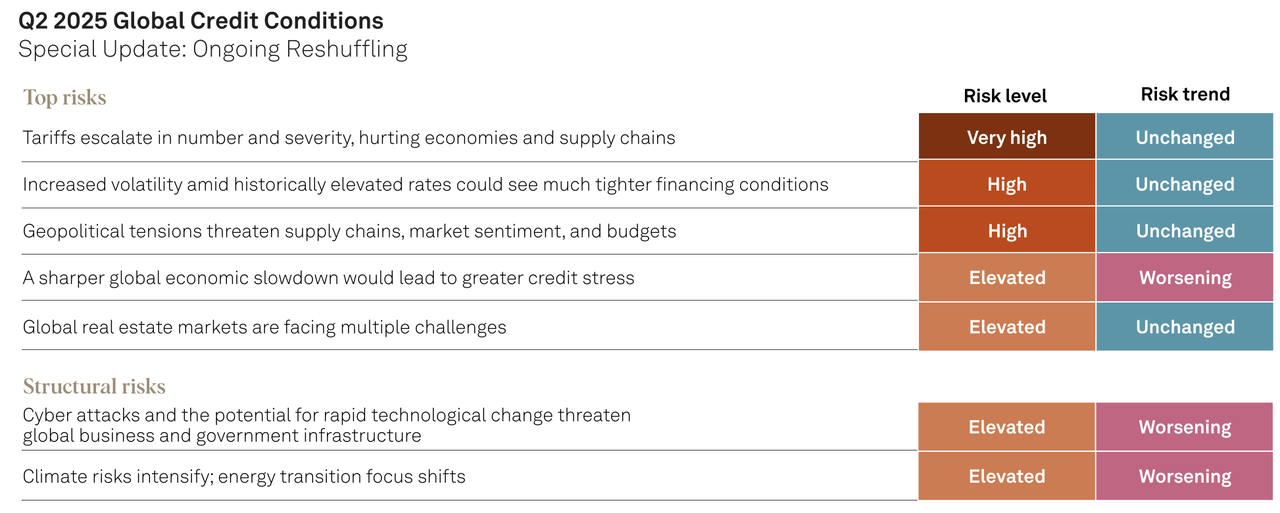

Finally, credit conditions are worsening, as you can see below, especially regarding economic slowdown, cyberattacks, and climate risks. This is a big deal for Visa.

Global Credit Conditions (S&P Global)

Yet, as unexpected as it might seem, I do expect an overly positive reaction of the market from the U.S.-China truce regarding the trade war and 90-day pause in the tariffs placed. However, the overreaction, as positive as it could be, might not benefit investors because of the current instability markets are facing. I'll still be looking forward to a fast and deep correction after this spike if it happens.

Careful, Don't Overcharge Here

I believe in the strength of Visa's brand recognition, IP, management, and strategy. The company is strong globally and difficult to substitute, let alone bypass its network, VisaNet. However, excitement this strong that doesn't seem to have an end in sight, must make us ask a fundamental question: what are we looking for?

As investors, we are looking for a good entry price and to make a good return, while keeping risks as low as possible. For me, the current risks given Visa's price and the current market state, compared to the return I could make, are just unattractive. There are plenty of emerging technologies, riskier than Visa, yes, but more attractive in terms of reward. And they're trendy, meaning that they are driven by positive sentiment.

Another question to ask would be: will this high current price get any better?

The answer is yes, but how? The 44% overpricing that my DCF model presented might be too biased to solely focus on, ignoring all the intangible assets and strong growth, presence, and programs Visa has.

My hold recommendation is based on a long-term view. The market will eventually stabilize, and Visa will sustain its growth. It is therefore more attractive to hold the stock now rather than to sell it as it hasn't shown a bearish trend starting.

Practically speaking, I am looking for the current stock price to either prove it can sustain itself above $350 until the current broader market volatility stabilizes. Then, the risk-to-reward ratio will be very attractive. Or I would be looking to buy around $330 after a clean and slow pullback correction.

My analysis is also based on looking at Visa's price action. I do not expect the excitement shown in the following chart (bullish move between mid-April to the start of May) to sustain itself without a pullback. Plus, the numbers I mentioned prove some resistance, which I refer to as bouncing areas from where people buy back the stock, a resistance price like the $330 price I mentioned.

In the other, optimistic eventuality mentioned, my thought process is the same — if the price holds above its current level, I'll consider it as an accepted price by the market, from where it could continue its bullish move.

Visa Stock's Chart (Seeking Alpha)

Summing Up

In conclusion, for the reasons I mentioned, and because I do not deem the current positive sentiment showed by the market to be real or trustworthy in that I find a lag between the sentiment described and the market state, I do not own any Visa stock whatsoever, and will not until I perceive some market stabilization and a sustained company's growth.

However, I believe that holding it is more beneficial for those who already own it as Visa shows no bearish indications just yet.